Handler claimed 1989 that “defining the family firm is the first and most obvious challenge facing family business researchers” (Methodological Issues and Considerations in Studying Family Businesses, 258). In 2011 Litz, Pearson and Litchfield found out that between 54% of 80 surveyed family business researchers there is almost no consensus on the definition of family businesses (Charting the Future of Family Business Research: Perspectives From the Field).

Despite the fact that family business research has not yet found a commonly accepted definition, it seems that the researchers generally define them based on three perspectives (Handler 1989): dominant ownership, family and the cross-generational aspiration to do business (May 2012).

First, dominant ownership based on the degree of ownership and/or management (Dyer 1986) (Lansberg, Perrow and Rogolsky 1988) that allows the family to influence the most important business decisions in their interest (May 2012). Second, Family, i.e. degree of family involvement in the business (Davis 1983) (Lansberg 1983), the so-called “components-of-involvement” (COI) approach. It is also called the demographic approach (Basco 2013) and defines a family business over the involvement of a family in the company, i.e. its influence through ownership, management and/or governance. (Zellweger, Eddlestone and Kellermanns 2010) (Mazzi 2011). Third, cross-generational aspiration, i.e. the essence of the family business, its behavior to be a family business and the family members involved wish to retain this status (Chrisman, Chua and Sharma 2005) and to transfer the business to the next generation (Churchill und Hatten 1997) (Ward 2011).

Chua, Chrisman and Sharma proposed a slightly different theoretical definition of family business: “a company is a family business because it behaves as one and that this behavior is distinct from that of non-family firms” (Defining the family business by behaviour. 1999)

In China private firms distinguish two different forms “private firms” (个体户 gè tǐ hù) and “privately managed industry” (私营企业sī yíng qǐ yè) (Wu 2006) as one opposite to the “state-owned enterprises” (国有企业 guó yǒu qǐ yè). Privately managed industries match more with the above defined characteristics of a family business. Private firms in mainland China are more about self-employment with a private business hiring less than 8 employees.

To understand family businesses in China, one must understand Confucian traditions that relates to family, social ethics, loyalty to a hierarchical structure of authority and trust between close friends, relatives and family members. Family businesses tend to do business with those who share a common culture and direction, where the collective good of the group and society is more important than the needs of the individual. Many relationships are formed based on informal networks (关系 guānxi) lacking a formal documentation system (Weidenbaum 1996). To achieve the success and sustainability of the family firms, Chinese entrepreneurs came to a modern value of Confucian thinking to combine traditional features and cultural heritage with management thinking, entrepreneurial spirit and a unique commercial culture (Wah 2001).

The International Family Enterprise Research Academy (IFERA) reports 2003 (Family Businesses Dominate) that 96% of all US companies are family businesses, but contribute only with 40% (-50%) to the gross domestic product (GDP). Whereas in Europe from 60% in Germany/France over 70% in Belgium, 75% in Spain up to 80% in Finland and Greece are family businesses. Despite Finland with 45% of GDP (-35%) the difference is more moderate, Belgium 55% (-15%) and Spain 65% (-10%), insignificant in Germany 55% (-5%) or even nonexistent in France with 60% (+/- 0). (International Family Enterprise Research Academy (IFERA) 2003)

An increasing number of family businesses had been very important to China´s economic success and rapid growth (Tsui, Cheng and Bian 2006). The privately managed industry (私营企业sī yíng qǐ yè) contributed in the past decade to more than 66.7% of the GDP in China (Wu 2006).

The world´s largest export nations are China (US$2.157 trillion), USA (US$1.576 trillion) and Germany (US$1.401 trillion), but while this is only 11.9% of the GDP in the USA and 19.6% in China, it accounts for nearly 50% (46.1%) in Germany. (Wikipedia, List of Countries by Export 2019)

The German successes in export are coming less from large enterprises, but from SMEs. Germany has more hidden champions than any other country in the world. The large number of hidden champions can be explained from the history of the 19th century, when Germany was not one nation, but split in many small states with traditional decentral competences, which made it already necessary to trade across borders. This developed already the mindset for internationalization. (Simon 2012, 79f.)

The strength of these businesses is that they do not offer a broad portfolio but are very specialized in their offerings and focus often in niche markets, being 100% customer oriented. The success factor is constant growth. Globalization and innovation are the outstanding engines of growth. But an innovation can be considered a success only if it had proved itself on the market. “Whereas the industry study cited found that 23% of revenues were generated by new products, the percentage is much higher among innovative hidden champions.” (Simon 2012, 273). The range is between generating 48% of revenues with products that are less than 2 years on the market (Bosch Power Tools) or 85% with products younger than 5 years (Kärcher). As there is no definition of a new product, the comparability of these indicators seems not clear, but show that these companies are very innovative. “It is always impressive to see what the hidden champions produce with relatively small R&D budgets and teams.” Therefor quality of people is more important to innovation than money. Loosing such experts can become a serious risk for the companies (Simon 2012). “Superior results seem to be a function of the quality of an organization´s innovation process rather than the magnitude of its innovation spending” (Jaruzelski, Dehoff and Bordia 2005, 2)

Many of these businesses grow from visionary self-employed entrepreneurial inventors, who stay as role models for generations, over hidden champions to big champions with more than US$5bn in revenue and more than 5000 employees. The risk of specializing is that they are highly dependent on their focus markets, the often high-price market niche can be attacked by standard products or by low-cost suppliers. They are exposed to a high risk of technological change. The threatening situation caused by changing technological requirements makes it mandatory for companies in highly specialized markets to take the leap in technology to be able to survive. (Simon 2012)

Besides failing due to technology change, more often family businesses break down as a result of an unsuccessful succession. To understand the difficulties of transition processes inside a family business May (2012) classifies them in 3 dimensions: ownership structure, company structure and governance structure .

The ownership structure and its complexity are increasing from a controlling owner over a sibling partnership, cousin consortium to a family dynasty. In companies with a controlling owner you often find the founding entrepreneurial inventor, being the unquestioned visionary and leading in many cases with a patriarchal style. Most conflicts and risks to fail are in a sibling partnership stage and cousin consortiums, where jealousy plays a big role especially when money, power and heritage are unequal distributed among the descendants of the family. With an increasing number of family members (>30) and shrinking shares in a family dynasty, many owners start to see the business only as an investment and loose the relationship to the company (May 2012). Still the difference to a public company or private equity fond is the homogeneous ownership structure. (Habbershon und Williams 1999) describe it as the “familiness”. “It is the unique bundle of resources a particular firm has, because of the system interactions between the family, its individual members, and the business” (Habbershon und Williams 1999, 11), which is a precondition for continuity over many generations.

The major issue with the company structure is the risk resp. the risk limitation. The risk is increasing starting from a family start-up business over the focused and then the diversified family business up to the family investment office. While in the start-up and the focused family business the necessary competences and identification can be found in the family, it will be difficult with a more and more diversified investment. (May 2012)

The central aspect of the governance structure in a family business is the principal-agent-problem. Jensen and Meckling (1976) describe the conflicts of interest, when the owners (principals) assign external managers (agents) to lead the business. In other words, an external manager deals with other people’s money different than the owner. While the owner is interested in the return of the invested capital, it is the focus of the external manager to increase the own value. This risk is significantly lower when the owner or family members are managing the own business but is increasing when the business is only controlled by the family or even the control of the family business is executed by externals.

Family businesses facing the same issues as public companies, but added the problems connected with the family. On the one hand with the increasing complexity of the ownership and company structure it then becomes necessary to create formal mechanism of coordination, planning and organization of family meetings. On the other hand, similar to other companies it is common to promote or fire people, set goals or measure performance. The difference here is, that these decisions affect members of the family – a father, sibling, son, daughter or cousin (Rodrigues und André Marques 2013). Typical risks are family patriarchs who despite their old age are unable to let loose of the business or parents which promote their insufficient prepared children (May 2012, 144). These authors argue that there is a way to minimize the impacts of these problems by establishing a form of organizational governance for each of the subsystems, family and business.

Astrachan, Klein and Smyrnios (2002) introduced the F-PEC scale measuring the family business in the dimensions of power, experiences and culture. Power as in the 3-dimensional model (May 2012). Experiences coming from the generations of ownership, in active management/governance and number of contributing family members. Culture, i.e. the overlap between family values and business values and the commitment to the family business. Marín et al. (2017, 2) summarize in their study about organizational culture and family business different sources that “organizational culture has been traditionally considered as one of the most important intangible strategic resources in developing competitive advantages […]. Organizational culture is even of greater importance in the sphere of the family firm, where a set of beliefs and interests, highly influenced by the family relations […], may produce significant differences from any other non-family organizations […].” They conclude that to prevent the risk of subsequent loss of family wealth and family control and if family business want to change their emotional, internally-oriented organizational culture towards a more rational, market-oriented organizational culture, family owners and managers should consider “a professionalized and dynamic culture that favours innovation, internationalization and financial outcomes” (Marín, et al. 2017, 8)

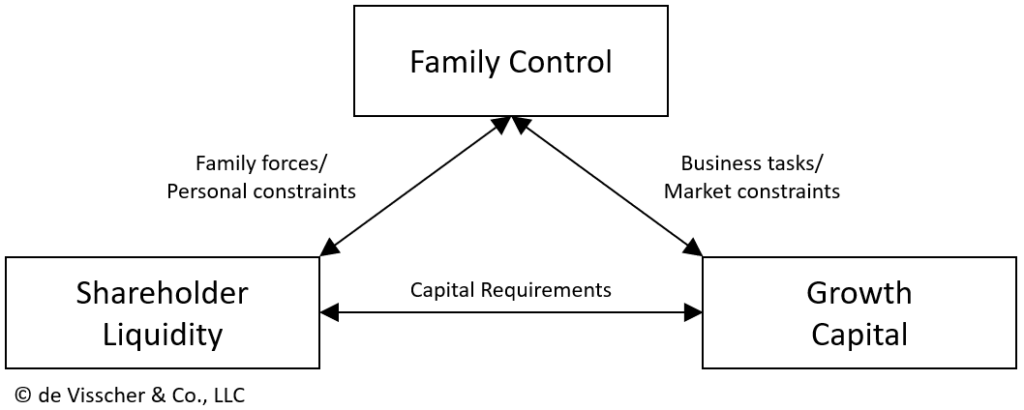

“Throughout the world and across the centuries, family businesses share a common set of challenges: liquidity for the shareholders, capital for business growth, and responsiveness to shareholders’ control objectives.” (Visscher, et al. 2011, 1) Family businesses have different types of liquidity needs related to the family be it the dividends for the invested capital, desire for income or to settle liabilities in case of a shareholder’s death. A family business needs capital to fund the working capital as well as the growth plans of the firm. “The business’s needs for and access to sources of growth capital are likely to increase as the forces of competition, globalization and innovation challenge the company” (Visscher, et al. 2011, 5). “The more control the family desires, the less liquidity will be available to shareholders and the less capital will be available to expand the business” (Visscher, et al. 2011, 6).

In other words, the risk is that the family loose its control over the business when the growth plans become too ambitious. If the company’s independence from third-party influence is most important as the company should remain a family business, then stability must take precedence over profitability and growth. To be able that the family remains to play a dominant ownership role, the business depends on the financial resources provided by the family (May 2012). May also says when rejecting outside influence “the most contribution to the financing is the profit” as this is the major source for strengthening the equity capital in the family business (2012, 105).

Michiels and Molly (2017) collated “that the literature still remains inconclusive on the level of debt used in family firms. […] A trade-off needs to be made in family firms between the retention of control, which favors the use of debt financing over external equity, and risk aversion, which stimulates the company to adopt more cautious attitudes towards debt […]” (Michiels and Molly 2017, 374). Schulze, Lubatkin and Dino (2017) researched the use of debts of family businesses esp. in relation to the ownership structure. They found evidence that sibling partnerships use less debts and are therefor less willing to take risks than controlling owners or cousin consortiums, who show an increased level of loss aversion and misalignment within the family. According to Visscher et al. (2011) companies in the start-up phase more likely fund the capital needs with internal cash-flow and short-term debts, while focused and diversified businesses use longer-term debts until family investment offices may also go to the private or public equity market.

According to May “Low Leverage is Key”, family businesses need high equity ratios. While financial investors use the effect of leverage to maximize the return of the invested capital, do family businesses exact the opposite. To stay as independent family businesses and be profitable over many generations, they favor financial stability. Among the top family businesses May has seldom seen a worse ratios than 1:2 of external financing to equity capital. (May 2012, 108ff.) The research from Hermann Simon showed that Hidden Champions have an average equity ratio of 42% und under the assumption of costs of debts of 6%, their return on equity (ROE) is 25%. (Simon 2012, 342)

As a conclusion, family businesses are characterized by a dominant ownership, “familiness” and the aspiration to stay independent and within the family for many generations. Worldwide most of the businesses are family firms with a high contribution to the GDP, especially in Germany. Their success factor is coming from constant growth, where globalization and innovation play an important role. To be able to stay in control of the family business with the challenges of increasing family members over the generations in the dimensions of ownership, company and governance structure an equilibrium between control, cash flow and capital needs must be achieved. A high ROE and therefor high equity ratio increase the entrepreneurial freedom and creates good conditions for the typical competitive advantage in family businesses in the form of quick decisions uninfluenced by external constraints.

Works Cited

Astrachan, Joseph H., Sabine B. Klein, and Kosmas X. Smyrnios. “The F-PEC scale of Family Influence: A Proposal for solving the Family Business Definition Problem.” Family Business Review, 03 01, 2002: 45-58.

Basco, Rodrigo. „The family’s effect on family firm performance: A model testing the demographic and essence approaches.“ Journal of Family Business Strategy, 01. 03 2013: 42-66.

Centre for European Economic Research (ZEW); Institut for SME Research (ifm). Handout Family Businesses. Report, Munich: Foundation for Family Businesses, 2019.

Chrisman, James J., Jess H. Chua, and Pramodita Sharma. “Trends and Directions in the Development of a Strategic Management Theory of the Family Firm.” Ent. Theory & Pract (Entrepreneurship Theory and Practice), 09 01, 2005: 555-576.

Chua, Jess H., James J. Chrisman, and Pramodita Sharma. “Defining the family business by behaviour.” Entrepreneurship Theory and Practice, 07 04, 1999: 19-39.

Churchill, Neil C., und Kenneth J. Hatten. „Non-Market-Based Transfers of Wealth and Power: A Research Framework for Family Business.“ Family Business Review, March 1997: 53-67.

Davis, Peter. “Realizing the potential of the family business.” Organizational Dynamics, Summer 1983: 47-56.

Dyer, W. Gibb. Cultural change in family firms: Anticipating and managing business and family transitions. San Francisco: Jossey-Bass, 1986.

Habbershon, Timothy G., und Mary L. Williams. „A Resource-Based Framework for Assessing the Strategic Advantages of Family Firms.“ Family Business Review, 01. 03 1999: 1-25.

Handler, Wendy C. “Methodological Issues and Considerations in Studying Family Businesses.” Family Business Review, 09 01, 1989: 257-276.

International Family Enterprise Research Academy (IFERA). „Family Businesses Dominate.“ Family Business Review, 01. 12 2003: 235-240.

Jaruzelski, Barry, Kevin Dehoff, and Rakesh Bordia. Money Isn´t Everything. Report, Booz & Company, 2005.

Jensen, Michael C., und William H. Meckling. „Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure.“ Journal of Financial Economic, 10 1976: 305-360.

Lansberg, Ivan S. “Managing human resources in family firms: The problem of institutional overlap.” Organizational Dynamics, Summer 1983: 39-46.

Lansberg, Ivan, Edith L. Perrow, and Sharon Rogolsky. “Editors’ Notes: “Family Business as an Emerging Field”.” Family Business Review, 03 1988: 1-8.

Litz, Reginald A., Allison W. Pearson, and Shanan Litchfield. “Charting the Future of Family Business Research: Perspectives From the Field.” Family Business Review, 08 23, 2011: 16-23.

Marín, Gregorio Sánchez, Antonio José Carrasco Hernández, Ignacio Danvila del Valle, und Miguel Ángel Sastre Castillo. „Organizational culture and family business: A configurational approach.“ European Journal of Family Business , 06 2017: 1-9.

May, Peter. Erfolgsmodell Familienunternehmen. Das Strategie Buch. Hamburg: Murrmann, 2012.

Mazzi, Chiara. „Family Business and Financial Performance: Current State of Knowledge and Future Research.“ Journal of Family Business Strategy, 07. 07 2011: 166-181.

Michiels, Anneleen, and Vincent Molly. “Financial Decisions in Family Businesses: A Review and Suggestions for Developing in the Field.” Family Business Review, 11 7, 2017: 369-399.

Rodrigues, Jorge, und María Amélia André Marques. „Governance bodies of family business.“ EJFB (European Journal Of Family Business), 2013: 47-58.

Schulze, William S., Michael H. Lubatkin, and Richard N. Dino. “Exploring the Agency Consequences of Ownership Dispersion Among the Directors of Private Family Firms.” Academy of Management Journal, 11 30, 2017: 179-194.

Simon, Hermann. Hidden Champions – Aufbruch nach Globalia. Die Erfolgsstrategien unbekannter Weltmarktführer. Frankfurt am Main: Campus Verlag, 2012.

—. Hidden Champions – The Vanguard of Germany in Globalia. 14. 12 2017. http://eworkcapital.com/hidden-champions-the-vanguard-of-germany-in-globalia/ (Zugriff am 14. 07 2019).

Tsui, Anne S., Leonard Kwok-Hon Cheng, and Yanjie Bian. China’s domestic private firms: Multidisciplinary perspectives on management and performance. Armonk, N.Y: M.E. Sharpe, 2006.

Visscher, François M. de, Craig E. Aronoff, John L. Ward, and Drew S. Mendoza. Financing Transitions: Managing Capital and Liquidity in the Family Business. 2nd edition. New York: Palgrave Macmillan US, 2011.

Wah, Sheh Seow. “Chinese Cultural Values and their Implication to Chinese.” Singapore Management Review, 2001: 75-83.

Ward, John L. Keeping the family business healthy. How to plan for continuing growth, profitability, and family leadership. New York, NY: Palgrave Macmillan, 2011.

Weidenbaum, Murray. “The Chinese Family Business Enterprise.” California Management Review, 07 01, 1996: 141-156.

Wikipedia, List of Countries by Export. 07 15, 2019. https://en.wikipedia.org/wiki/List_of_countries_by_exports (accessed 07 15, 2019).

Wu, X.G. “Family businesses in China, 1978-96: entry and performance.” in Tsui, Anne S.; Cheng, Leonard Kwok-Hon; Bian, Yanjie, China’s domestic private firms. Multidisciplinary perspectives on management and performance, Armonk, NY: M.E. Sharpe, 2006: 40-64.

Zellweger, Thomas M., Kimberly A. Eddlestone, and Franz W. Kellermanns. “Exploring the Concept of Familiness: Introducing Family Firm Identity.” Journal of Family Business Strategy, 02 06, 2010: 54-63.