Finding 1: No digital transformation strategy and being digital followers

Freimark et al. (2018) asked the question, whether hidden champions are also champions of digital transformation and did a survey in Germany. The results show that only 28,4% of the hidden champions have a detailed digitalization strategy, 48,1% have a rough digitalization strategy (cf. Figure 1). Only 17%, i.e. 1 out of the 6 cases, have a detailed digitalization strategy (Case 4). Case 2, 5 and maybe 3 have rough digitalization strategies, that is 33-50%.

Case 4 has a detailed and released digitalization strategy, but I would not consider it a digital transformation strategy (cf. Digital Transformation Definitions) as it is technology driven and only make use of the digital technologies for productions and customer relations.

In the international comparison (Geissbauer, et al. 2018), 5% in EMEA are digital champions, 20% digital innovators, 45% digital followers and 30% digital novices (cf. Figure 2). Among the cases studied there is no digital champion, 16% digital innovators (Case 1), 67% digital followers (Case 2,3,4 and 5) and 16% digital novices.

Case 1 has not a released digital strategy, but I rate them as digital innovators, because digitalization is for them integral part of their innovation driven corporate strategy. “Digital strategy is for us, how to setup the different organization units. We opened a digital lab. We hired 50 people with skills we had not before, like UX, scrum, agile topics, data scientists etc. […] It must pay into the direction of the consumer or research. Speed up Time-to-Market or make it smarter.” (Case 1)

Geissbauer et al. (2018, 14f.) say that ”among industries, automotive and electronics had the largest share of Digital Champions, at 20% and 14%. Consumer good, industrial manufacturing, and process industry lag significantly behind”.

Case 1 and 4 belong to the process industry, Pharmaceuticals and Chemicals, whereas Manufacturing & Industrial Products and Automotive & Assembly are staying behind.

All companies show a constant revenue growth and Germany is the third largest export nation after China and the USA and the export account for nearly 50% of the GDP) in Germany (Wikipedia, List of Countries by Export 2019). Mensch (1982) found out that during times of economic prosperity, companies are not willing to take high risks. On top of this family-owned businesses are conservative, risk-averse, show a lack of openness and readiness to change (Cassia, Massis and Pizzurno 2012).

Therefor it is not a surprise, that these companies show no active motivation to formulate and implement a digital transformation strategy. They only deal with the topic of digitalization and they see no need for a business transformation due to digitalization, as it is usually characterized by a high level of uncertainty as this affects not only products and processes but transforms key business operations as well as organizational structures and management concepts. (Matt, Hess and Benlian 2015)

Finding 2: Lack of Innovation

Only Case 2 reports a KPI related to innovation. The company “measures the effectiveness of Research and Development activities using the share of new products. These are products younger than four years in percentage of sales. This is 33,6%.” (Case 2)

Surprisingly Case 2 invests more into capital expenditure (6% of revenue) than into R&D (4% of revenue). As there is no definition for a new product, it might not be clear, whether these are product updating measures to extend the lifecycle of existing products or real innovations. But Simon (2012) reports: “It is always impressive to see what the hidden champions produce with relatively small R&D budgets”.

Like Case 2 also has Case 6 a balanced ratio between capital expenditure and R&D investments.

Case 1 is the only company, which invests significantly more into R&D (18% of revenues) than into CAPEX (5% of revenue). This company is a researching pharmaceutical company, where the development of new pharmaceutical products and research in this field is very expensive (DiMasi, Grabowski and Hansen 2016), but also very much depending on innovations.

Case 3 and 4 show a significant unbalanced ratio between investments into property, plants and equipment (CAPEX) and R&D. The difference with Case 3 is 9 percent points (CAPEX 14% of revenue to R&D 5% of revenue) and 6 percent point with Case 4 (CAPEX 9% of revenue, R&D 3% of revenue). This can be interpreted in two ways. First, that developing new products can be done very easily, but demand later high investments into production capacities to manufacture and distribute the innovations into the market. Second, that these companies have the focus on existing products and producing higher volumes. Companies with innovations in a growing stage show increasing sales and profit due to the benefits from economics of scale (Luna 2019). But except Case 1 all cases show growing revenues and declining EBIT margins, which is more an indicator, that they lack real innovations.

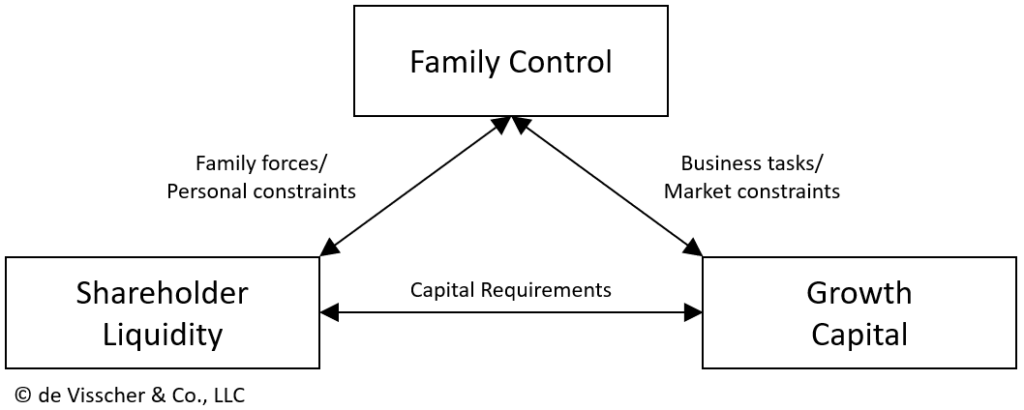

Another explanation for the lack of innovations, can be cash-flow problems. Innovations have an uncertain future, whether these investments will bring any return, but companies need to fulfill the capital needs to be able to afford the investments. May (2012) says “the most contribution to the financing is profit”. Family businesses prefer financial independence. Except Cases 6 and 5, where I did not get the information, all companies have an equity ratio above 40%. But the only company who is fulfilling the capital needs is Case 1 with a constant increasing EBIT margin of actual 18% which they invest into innovation. This might be another reason for the lower investments into R&D as they have the need to finance further growth. On top Case 3 and 6 have much higher capital expenditures than EBIT, which most probably mean, that they need to finance their investments with debts.

Finding 3: Possible Disruption

All cases show a constant revenue growth (CAGR) over the last 4 business years, but except Case 1 they report a declining EBIT margin (CAGR) over the same period.

The loss of profitability can be interpreted from the companies in two ways:

First, internal costs are too high, because of e.g. a low degree of automation. Except Case 1, all other companies choose more defensive strategic approaches like seeking cost efficiency or improving selling expenses (Bughin and Zeebroeck 2017). Under this assumption it makes sense that the companies have no digital transformation, but only a digitalization strategy, i.e. IT enabled transformation, which pays into giving back a competitive advantage, cf. Digital Transformation Definitions (Venkatraman 1994) (Porter and Millar 1985), but does not prevent disruption.

Second, as revenues are growing and profitability is shrinking another explanation can be, that the products have reached a stage of maturity and sales growth is only coming by focusing on the product and the production of higher volumes with the need to do this at a lower cost (Luna 2019). Disruption is possible when at the time of a product-focused stage of maturity a new technology is in the growing phase offering a similar customer value to a lower price or even make the products redundant (Christensen 1992).

Finding 4: Drivers of the digital transformation strategy

In Why do Companies Digitally Transform I gave a summary of drivers of the digital transformation strategy retrieved from the current state of research. Internal motivations should be efficiency increase or pressure coming from tech savvy employees as well as corporate social responsibility and sustainability. External triggers the exponentially accelerating emerging technologies, tech savvy and pro-activeness demanding customers as well as pressure coming from society and government regulations.

But our cases in general only confirm the statement of Arnold (2018), that the typical European and German digital strategy approach is to be technological driven focused on traditional European skills.

Cases 2 and 4 clearly confirm that, but the dimension “Technology & Security” is the only building block of the digital transformation strategy that had been confirmed by all companies. The declining EBIT margin shows, that the companies want to achieve cost savings due to digitalization to improve the situation.

Cases 1 and 5 report product innovation as a driver of the digital transformation strategy, but they make use of technology to come to new products and services. Case 1 for example said the motivation for them to do the digital transformation is to come to “new products, where the product is not a pill anymore, but a hardware-software device, which we develop in our digital labs” (Case 1).

That is at least according to Burghin and Zeebroeck (2017) a sign for an offensive strategy, where top performing companies could achieve more than 80 percent higher revenues than the industry average and achieve a digital return on investment (ROI) that is 10 times higher than the low performing companies.

Finding 5: Dimension of the digital transformation strategy

Gouillart, Kelly and Gemini Consulting (1999) say that the business models originate from the industrial age and are influenced by mechanical engineering. In the digital age these business models come to a limit. Business transformation means a fundamental change, where a company needs to redefine all dimensions.

Only Case 1 and 3 consider all dimension in their digital transformation strategy, followed by Case 6 which do not consider new ways of working. Table 3 shows the counts of dimensions considered in the digital transformation strategies of the cases in comparison to the order critical to success (cf. Digital Transformation Content).

Although it is least important for success, all cases have the focus on technology, for Cases 2 and 4 this is also the main driver for the digital transformation strategy. On the other side, the dimension business model innovation, which is most critical to success, has the least counts among the six cases.

Business model innovation is the main pillar to make strategic decisions towards the future of the company. Kaltenecker, Hess and Huesing (2015) say that this is necessary to overcome the dilemma of possible disruptions by shifting from product selling to service offering (product-as-a-service). An enabler for business model innovation is “Platform Play” as an offensive strategy approach (Bughin and Zeebroeck 2017) and Berman (2012) show in relation to today’s business model the path of transformation.

Asked why they do not consider business model innovation, Case 2 answered “it is quite clear that the business groups, first have to have a certain critical size, b) must have a certain brainpower, both in management and IT, as well as in other functions, because they are on a completely different level than smaller business groups, which also quite frankly say that they have neither the capacity nor the imagination at all.” (Case 2)

When generalizing this statement, it justifies that a digital transformation strategy cannot be separated from the dimensions of culture, leadership, HR & skills and why technology is least critical to success, as the existence of a technology does not help to overcome the lack of imagination to change to new business models.

The main motivation for cases 1 and 5 is product innovation, where the rank in counts matches with the criticality related to success. Case 3 has more an organizational motivation with “Transparency, Speed and Collaboration” which is reflected in the dimensions culture, leadership and ways of working. Case 5 reports first results in production with their strategy, but do not consider production as part of the dimensions. Case 4 do not consider the most critical dimensions and Case 3 has only a focus on technological advancements.

This overall incomprehensive picture across the cases shows the high level of uncertainty connected with the digital transformation. This is consistent through the different structures of family-owned businesses, whether they are family-controlled or family-managed, sibling partnerships, cousin consortiums or focused businesses (cf. Family Businesses).

Finding 6: Missing goals for the digital transformation strategy

The first of six principles of strategic positioning formulated by Porter (2001, 71) is: Start with the right goal: long-term return on investment. Ismael, Khater and Zaki (2017) summarized in their synthesized framework for “Digital Transformation Strategy Content” as the first out of seven key areas: long-term objectives, business scope and revenue streams from digitally enhanced products. Kane, Palmer et al. (2015) conclude that rather focusing on technological opportunities, companies should focus to use technologies to achieve strategic goals.

In all cases, the strategic direction of the companies is given by a vision and goals. While you can argue, whether the visions motivate the employees to change, the goals help to prioritize activities and can be measured. Only with targets the financing and investments needed to fulfill these goals can be determined and prioritized to keep the cash-flow under control.

Case 1, 3, 5 and 6 have given the information that they have no specified goals for a digital transformation and no target to explicit change the value proposition and break this down in which regards these influences and changes the value chain. So far, the elements do not fit together. Case 2 have at least a revenue target for revenues done over the e-commerce channel, but this does not change the value proposition and pays into a defense strategy (cf. Digital Transformation Process, Table 5). Case 4 has (defensive) goals which pay into a positive effect of the corporate targets and can be determined for the financing and investments of the digital transformation. “We have also described certain expectations related to savings. The responsible for this goal and its achievement is not the digital program, but the core business, which had confirmed them. So, we’re talking about larger double-digit million amounts that are the committed [for the digital transformation, note from the author]” (Case 4)

Finding 7: Lack of a systematic approach for the formulation and implementation of a digital transformation strategy

All cases seem to have a corporate strategy following a mature proven approach for strategy formulation inside the companies. Table 4 shows the comparison of the corporate strategy with the digital strategy of each case.

In all cases the corporate strategy process includes a clearly defined responsibility, a communication of the strategy inside of the organization, a strategy cycle, a release date and a regular revision of the results measured by KPIs, which are mainly financial figures. All cases have a strategic vision.

Although a systematic approach is crucial for success (Matt, Hess and Benlian 2015), none of the cases follows neither the procedure of the corporate strategy nor any existing frameworks like described in the Digital Transformation Process. Only in Case 1 and 4 the digital transformation is coupled with the corporate strategy and alongside the functional strategies. Case 3, 5 and 6 reports that they have a self-developed framework to formulate and implement their digital transformation strategy. Case 2 and 4 report, that they are not using any methodology to formulate and implement a digital transformation strategy, but surprisingly say that the digital strategy have been officially released. Case 5 has already 2016 released their strategy, while Case 3 is about to release it.

The drivers of digital transformation are the exponentially growing emerging technologies and the technological change will accelerate with such speed that “society will spend less and less time at any particular technological level” (Lee 2013). The more it is surprising that except Case 4, none of the cases consider a strategy cycle to renew the digital strategy or even only 2 out of 6 cases consider a regular revision of the strategy (Case 4 and 6). Case 5 said “we have a digital strategy; do we need another one?”.

A digital transformation strategy makes it mandatory to align, coordinate and prioritize the many independent dimensions across all other strategies. It these tasks are executed half-heartedly; the formulation and implementation might lose the scope with possible serious effects on operations (Matt, Hess and Benlian 2015). While the responsibility for the corporate strategy is with the CEO or the executive board, only Case 4 and 5 have dedicated roles in their company, where CDOs are officially empowered to formulate and implement a digital transformation strategy. Case 4 is at the same time also the CIO of the company, which gives the topic a more technological driven aspect, where the other dimensions might step into the background. Analog case 1, where the CFO is the former CIO and takes over an equivalent function as a CDO. Regarding to the information retrieved all the above functions serve as a coordinating function. Case 3 is with their digital transformation strategy in an early stage and has a work group dealing with the topic, which can be successful, when it follows a cross-organizational setup and will serve later as a coordinating board. Case 2 and 3 have not clarified the clear responsibility inside the organization and has not assigned the task to a specific role. Managers inside these companies appoint themselves as being entrepreneurial or play the role of a digital evangelist to create awareness related to the digital transformation. “The former head of marketing […] did it in a marketing manner, tore down a firework […] and wanted to draw everyone into digital enthusiasm. And of course, he wanted to appoint himself to drive it forward.” (Case 2).

The formulation of a digital transformation strategy can be aligned into three phases (Feichtinger 2018), the “why”, the “what” and the “how”. The implementation follows the basic principles of change management described by Lewin (1947, 34): “Unfreezing, Moving, and Freezing of Group Standards”.

The “why” should be described by the drivers of the digital transformation strategy, the “what” with the dimensions. Regarding the “how” and the change management measures, Cases 3 and 6 report that they are at an early stage, Case 2 have just completed the formulation, Cases 1 and 4 say they are in the implementation and have achieved first results, Case 5 have achieved first results in production.

Implementation and change management demand a lot of communication to inform everyone and to move them into the new direction. While the corporate strategy will be communicated throughout the organization, mainly by the CEO and the board and with a top-down approach, it seems that the digital transformation strategy will not be communicated at all in half of the cases. The others are in preparation or follow the top-down approach. Only Case 4 has a planned communication: “There is a corresponding intranet and we are regular guests in corresponding townhall meetings. We are now in our second year on a digital roadshow. This means that they have visited all the major locations and presented the program and content accordingly, and in a certain way try to take each employee with them in their specific challenge” (Case 4).

Work Cited

Arnold, Heinrich. The European Path to Digital Transformation. 10 21, 2018. https://www.theglobalist.com/europe-germany-digitalization-technology-data/ (accessed 08 11, 2019).

Berman, Saul J. “Digital Transformation: opportunities to create new business models .” Strategy & Leadership, 40 (2), 2012: 16-24.

Bughin, Jacques, and Nicholas Van Zeebroeck. 6 Digital Strategies, and Why Some Work Better than Others. 07 31, 2017. https://hbr.org/2017/07/6-digital-strategies-and-why-some-work-better-than-others (accessed 08 19, 2019).

Cassia, Lucio, Alfredo de Massis, and Emanuele Pizzurno. “Strategic innovation and new product development in family firms.” International Journal of Entrepreneural Behaviour & Research, Vol. 18 (2), 03 2012: 198-232.

Christensen, Clayton M. “Exploring the limits of the Technology S-Curve. Part I and II.” Production and Operations Management, Vol 1 (4), Fall 1992: 334-366.

DiMasi, Joseph A., Henry G. Grabowski, and Ronald W. Hansen. “Innovation in the pharmaceutical industry: New estimates of R&D costs.” Journal of Health Economics, Vol 47, 2016: 20-33.

Feichtinger, Gudula. “Digitalization in SME : a framework to get from strategy to action.” 2018. http://repositum.tuwien.ac.at/urn:nbn:at:at-ubtuw:1-115120 (accessed 08 09, 2018).

Freimark, Alexander Jake, Johannes Habel, Simon Huelsboemer, Bianca Schmitz, and Matthias Teichmann. Hidden Champions- Champions der digitalen Transformation? München: IDG, 2018.

Geissbauer, Reinhard, Evelyn Lübben, Stefan Schrauf, and Steve Pillsbury. Global Digital Operations Study 2018. Digital Champions. How industry leaders build integrated operations ecosystems to deliver end-to-end customer solutions. Study, PWC, 2018.

Gouillart, Francis J., James N. Kelly, and Consulting Gemini. Transforming the organization <dt.>. Wien: Ueberreuter, 1999.

Ismael, Mariam H., Mohamed Khater, and Mohamed Zaki. “Digital Business Transformation: What Do We Know So Far?” University of Cambridge. 11 2017. https://cambridgeservicealliance.eng.cam.ac.uk/resources/Downloads/Monthly%20Papers/2017NovPaper_Mariam.pdf (accessed 07 26, 2019).

Kaltenecker, Natalie, Thomas Hess, and Stefan Huesig. “Managing potentially disruptive innovations in software companies: Transforming from On-premise to the On-demand.” The Journal of Strategic Information Systems, Vol. 24 (4), 12 2015: 234-250.

Kane, Gerald C., Doug Palmer, Anh Nguyen Philipps, David Kiron, and Natasha Buckley. Strategy, not Technology, Drives Digital Transformation. Research Report, MIT Sloan Management Review and Deloitte University Press, 2015.

Lee, Mike. Meeting aliens will be nothing like Star Trek – fact. 05 08, 2013. https://phys.org/news/2013-05-aliens-star-trekfact.html (accessed 07 31, 2019).

Lewin, Kurt. “Frontiers in Group Dynamics: .” Human Relations, Vol 1 (1), 1947: 5-41.

Luna, David C. Why Companies Need to Eat Their Children: A Comprehensive Guide to Disruption. Article, Berlin: Gamma Digital & Beyond, 2019.

Matt, Christian, Thomas Hess, and Alexander Benlian. “Digital Transformation Strategies.” Business & Information Systems Engineering, 05 14, 2015: 339-343.

May, Peter. Erfolgsmodell Familienunternehmen. Das Strategie Buch. Hamburg: Murrmann, 2012.

Mensch, Gerhard. Das technologische Patt: Innovation überwinden die Depression. Frankfurt am Mein: Umschau , 1982.

Porter, Michael E. “Strategy and the Internet.” Harvard Business Review, March 2001: 62-78.

Porter, Michael E., and Victor E. Millar. “How Information Gives You Competitive Advantage.” Harvard Business Review, July-August 1985: 85-103.

Simon, Hermann. Hidden Champions – Aufbruch nach Globalia. Die Erfolgsstrategien unbekannter Weltmarktführer. Frankfurt am Main: Campus Verlag, 2012.

Venkatraman, N. “IT enabled business transformation: From Automation to Business Scope Redefinition.” Sloan Management Review, Winter 1994: 73-87.

Wikipedia, List of Countries by Export. 07 15, 2019. https://en.wikipedia.org/wiki/List_of_countries_by_exports (accessed 07 15, 2019).