The term “Digital Economy” had been introduced 1996 by Don Tapscott in his book “The digital economy. Promise and peril in the age of networked intelligence.”, where he described how the internet would change the way we did business. (Tapscott 1996)

Today 56.8% of the world population is online. (Miniwatts Marketing Group 2019) and 15.2% of the global retail sales had been done over the web in 2018, coming from 11.3% in 2016 and 13.3% in 2017. The world´s two largest economies – the United States and China – dominate global retailing. China far outpaced the United States in ecommerce both in terms of sales and growth. (Young 2019)

“China is one of the world´s largest investors and adopters of digital technologies, and is home to one-third of the world´s unicorns (Authors remark: unicorns are defined as privately-held startups valued at over US$1 billion.). […] The government is actively encouraging digital innovation and entrepreneurship by giving companies room to experiment and offering support as an investor, developer, and consumer of new technologies. China´s digital transformation is already having a profound impact on its own economy and is likely to have an increasing influence on the worldwide digital landscape. China´s digital globalization is only just getting started and is gathering momentum. Through mergers and acquisitions (M&A), investments, the export of new business models, and technology partnerships, China could set the world´s digital frontier in the coming decades” (Woetzel, et al. 2017, 1)

Industry 4.0 is a label for an initiative of the comprehensive digitalization of the industrial manufacturing to be better prepared for the future. The term had been used by the German government as part of their high-tech strategy 2025 and a project of the same name. (Wikipedia n.d.)

Industry 4.0, or Digital Operations, is on the agenda of manufacturing companies around the globe. Digital Champions in this area achieve their competitive advantage by successfully orchestrating and integrating the four ecosystem layers: Customer Solutions, Operations, Technology and People. Just 10 percent of global manufacturing companies are Digital Champions, while almost two-thirds, have barely or not yet begun on the digital journey. (Geissbauer, et al. 2018)

China´s industry strategy is called “Made in China 2025” (MIC2025). The aim of the Chinese government with MIC2025 is to promote the restructuring of their economy. To become dominant in technology and innovation, the acquisition of key technologies of the 4th industrial revolution is in their focus. As a result of this strategy the direct investments from China has increased. A popular M&A target is the industry sector followed by consumer products and services then high technology. 35 out of 196 deals in Europe in 2018 had been done in Germany with a transaction volume of US$10.68bn followed by 34 in Great Britain with a transaction volume of only US$1.41bn. (Ernst & Young 2019)

China is well on its way to be the global leader in digitalization. It is a leading digital marketplace, made substantial headway in artificial intelligence (AI) applications, blockchain technology and quantum computing. Chinese companies competing successfully worldwide in information- and communication-technology (ICT) product. Beijing is proactively shaping international standards for emerging technologies including blockchain, Internet of Things (IoT) and 5G. For Europe, the loss of economic competitiveness in these fields is becoming a pressing concern. The ongoing transfer of dual-use technologies from Europe to China adds to these concerns. (Shi-Kupfer and Ohlberg 2019)

The top 2 German industries in export are automotive and machinery followed by chemistry and ICT. Germany is an extreme outlier with double the per capita exports (US$19,185) of other large European countries like France (US$8,988). China (US$1,782) still has very low per capita exports. Whilst for most countries there is indeed a strong correlation between the number of large firms and exports, there are two exceptions, China and Germany. Exact these two outliers are the leading export nations. What distinguishes them from other countries is the share of exports contributed by mid-sized firms. 68% of Chinese exports come from companies with less than 2,000 employees. In Germany the small and medium-sized enterprises (SME) contributes about 70% to exports. With a number of 1,307 in total, Germany has globally the most mid-sized world-market leaders, so called hidden champions. Followed by the USA with 366 and Japan with 220. A hidden champion is a company which is one of the top three in its global market, has less than US$5 billion in revenue, and is little known in the public. Many of them are family owned businesses. (Statistisches Bundesamt 2019) (Simon 2012)

While China is very ambitious in digital transformation, only 35.6% of companies in Germany have a detailed digitalization strategy. While more than the half of the larger enterprises (52.6%) prepare themselves for the digital transformation, it seems that only less than a third of the SMEs (25.6%) and hidden champions (28.4%) consider this important. (Freimark, et al. 2018, 9)

Table 1: Digitalization strategies in Germany, translated and adopted from (Freimark, et al. 2018, 9)

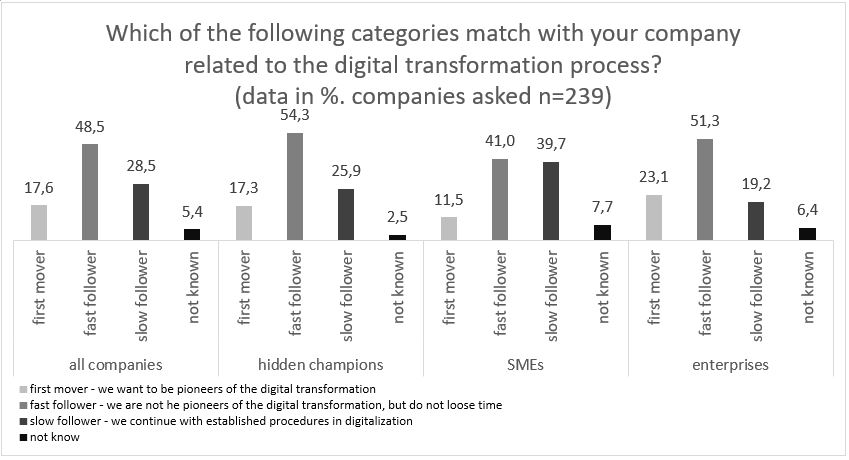

17.6% of companies in Germany see themselves as first movers, i.e. pioneers of the digital transformation. The majority with 48.5% see themselves as fast followers. Among them the hidden champions with an over average number of 54.3% despite the fact that less than a third has a detailed digitalization strategy. Only 41% of the SMEs see themselves as fast followers and almost the same amount (39.7%) say they are slow followers, i.e. continue with the established procedures in digitalization. (Freimark, et al. 2018, 10)

Table 2: Digital transformation path in Germany, translated and adopted from (Freimark, et al. 2018, 10)

Globally and in operations, only 10% of the companies surveyed

by PWC can call themselves digital champions. The majority with 42% are digital

followers.

From a regional perspective, Asian (APAC) companies are clearly most advanced,

with 19% from that region fall into the digital champion category, followed by

the Americas with 11%. European companies lag behind with just 5 percent in the

digital champion segment. (Geissbauer, et al. 2018, 14)

Table 3: Levels of digital maturity by geographic region, adopted from (Geissbauer, et al. 2018, 15)

Among industries, automotive and electronics had the largest share of Digital Champions, at 20% and 14%. Consumer goods, industrial manufacturing, and process industries lag significantly behind. (Geissbauer, et al. 2018, 14 f.)

Table 4: Levels of digital maturiy by industry, adopted from (Geissbauer, et al. 2018, 15)

The USA and Asia are better setup for the digital transformation as Europe. The top industries where digitalization is important are the top German industries in export and also the preferred M&A targets of China. In other words, Germany is producing “things” like in automotive and machinery, and China has the digital technologies to make them smart, like AI, blockchain, quantum computing, is leading in ICT and shaping all the related standards.

This is important, because the value potential of connected “things” are to enable new business models, e.g. remote monitoring enables everything as-a-service, and the transformation of business processes through predictive maintenance, better asset utilization and higher productivity (Manyika, et al. 2015). IoT is a critical data source to AI. With the introduction of the 5G standard for mobile internet, IoT connections will quickly overtake traditional mobile subscriptions. US$726.4 bn will be spend on IoT in 2019, 44.7% in Asia Pacific, 28.7% in the US and 21.2% in Europe. The IoT technology investments will reach US$1.12 trillion by 2023. 41.5bn connected IoT devices will be expected in the year 2025. The main focus for IoT applications at the moment are distribution & services in America and Europe, Middle East & Africa (EMEA) and manufacturing in Asia Pacific. (MacGillivray and Torchia 2019).

As a conclusion, the German industry is very attractive in the area of manufacturing, but it seems that being only a follower in the digital transformation makes the German industry prone to foreign takeovers. After a series of spectacular M&As from China like Putzmeister, Kion, Krauss-Maffei and Kuka intervened the German federal ministry of economics 2016 in the takeover of Aixtron. As a consequence, has the German government released a change in the foreign trade regulation in Juli 2017 to tighten the rules for foreign investments into German companies to prevent a further selling out of technology. (BMWi 2017), Rather than doing protectionism would be another option to close up with the rest of the world in the digital transformation. At the moment 8 out of the 10 most valuable brands in the world are companies of the digital economy (BrandZ 2019). And none of them are from Germany or even Europe.

Figure 1: Global top 10 most valuable brands (BrandZ 2019)

Works Cited

BMWi, Bundesministerium für Wirtschaft und Energie. Neunte Verordnung zur Änderung der Außenwirtschaftsverordnung – Verordnung der Bundesregierung. 07 12, 2017. https://www.bmwi.de/Redaktion/DE/Downloads/V/neunte-aendvo-awv.html (accessed 07 06, 2019).

BrandZ. BRANDZ GLOBAL TOP 100 MOST VALUABLE BRANDS. 07 06, 2019. https://brandz.com/brands (accessed 07 06, 2019).

Ernst & Young. Chinesische Unternehmenskäufe in Europa: Eine Analyse von M&A Deals 2006 – 2018. Ernst & Young, 2019.

Freimark, Alexander Jake, Johannes Habel, Simon Huelsboemer, Bianca Schmitz, and Matthias Teichmann. Hidden Champions- Champions der digitalen Transformation? München: IDG, 2018.

Geissbauer, Reinhard, Evelyn Lübben, Stefan Schrauf, and Steve Pillsbury. Global Digital Operations Study 2018. Digital Champions. How industry leaders build integrated operations ecosystems to deliver end-to-end customer solutions. Study, PWC, 2018.

MacGillivray, Carrie, and Marcus Torchia. Internet of Things: Market Spending & Trend Outlook. Presentation, IDC, 2019.

Manyika, James, et al. The Internet of Things: Mapping the value beyond the hype. Report, McKinsey Global Institute, 2015.

Miniwatts Marketing Group. Internet World Stats. 03 31, 2019. https://www.internetworldstats.com/stats.htm (accessed 06 29, 2019).

Shi-Kupfer, Kristin, and Mareike Ohlberg. China´s Digital Rise: Challenges for Europe. Berlin: Mercator Institute for China studies, 2019.

Simon, Hermann. Hidden Champions – Aufbruch nach Globalia. Die Erfolgsstrategien unbekannter Weltmarktführer. Frankfurt am Main: Campus Verlag, 2012.

Statistisches Bundesamt . Außenhandel. Zusammenfassende Übersichten für den Außenhandel (vorläufige Ergebnisse) 2018. Statistic, Wiesbaden: Statistisches Bundesamt, 2019.

Tapscott, Don. The digital economy. Promise and peril in the age of networked intelligence. New York, NY: McGraw-Hill, 1996.

Wikipedia. n.d. https://de.wikipedia.org/wiki/Industrie_4.0 (accessed 06 21, 2019).

Woetzel, Jonathan, Jeongmin Seong, Kevin Wei Wang, James Manyika, Michael Chui, und Wendy Wong. China´s digital economy: A leading global force. McKinsey Global Institute, 2017.

Young, Jessica. Global ecommerce sales grow 18% in 2018. 01 21, 2019. https://www.digitalcommerce360.com/article/global-ecommerce-sales/ (accessed 06 28, 2019).